Commercial Equipment Loans¹

Rates as low as

Commercial Auto Loans²

Rates as low as

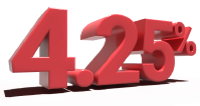

Commercial Owner-Occupied Real Estate Loans³

Rates as low as

Expand your business with new property. We are offering exclusive special fixed interest rates on commercial owner-occupied real estate loans, tailored to help you achieve your business goals. With competitive rates and flexible terms, securing financing for your commercial property has never been easier. Take advantage of this limited time offer and make your real estate aspirations a reality.

Requirements Made Simple

To qualify for these discounted rates, all you need is a First Community Bank Business Checking account and put our Digital Banking for Business system to work for you.* This digital suite is packed with technology to make your business day a breeze — including ACH, Remote Deposit Capture, Wire Transfer, Account Reconciliation, User Management, and more so you can focus on the real reason you went into business.

Not only are these rates generally lower than our competitors, but we deliver unparalleled support. Our dedicated Commercial Team is committed to being trusted banking partners, guiding you through every step of your business journey.

Ready to take your business to the next level?

Talk to your local commercial lender to start your application now to unlock these exclusive special discounted interest rates and propel your business forward with confidence.

All loans subject to credit approval.

¹Loan fee is $625 or .5% of the loan value, whichever is greater.

²Loan fee is $500 or .5% of the loan value, whichever is greater.

³Loan fee is .5% of the loan value.

* To qualify for discounted loan rates, open a qualifying business checking account within 10 days of loan closing. Maintain at least 10 qualifying transactions AND two remote deposits monthly. Active account holders must meet these criteria to continue receiving the rate discount. Digital Banking tools including Xpress by FCB mobile app, business online banking, remote deposit capture, and mobile deposit capture.

Average ledger balance is defined as the aggregate ledger balance divided by the number of aggregate days during the statement cycle.

Customers must meet all requirements for the lifetime of the loan. Business checking and loan activity may be monitored regularly, and failure to maintain any requirements may result in the loss of the discounted loan rates and the interest rate may then increase.